This article may include affiliate links for products discussed. This is at no additional cost to purchasers of any kind.

Table of Contents

- Intro

- So what's the best way to work around this?

- Good credit or bad, you should shop around for rates.

- Cross the T's, Dot the I's

- If you have the best rate you can get, do what you can to protect it.

- Explore bundling your rates.

- Take a refresher course.

- Try to save on other car related expenses.

- See how Debt Relief can help you.

Introduction

I was scrolling through my credit report on Experian last Saturday, as you do on a such an eventful weekend. There's a lot of information about the status of different accounts you have or had in the past. Alongside that, you get to peek at every single company who's over peeked at your report for any reason at all. I'm not sure why, but I was surprised to notice that Progressive has taken a couple looks at my report over the years.

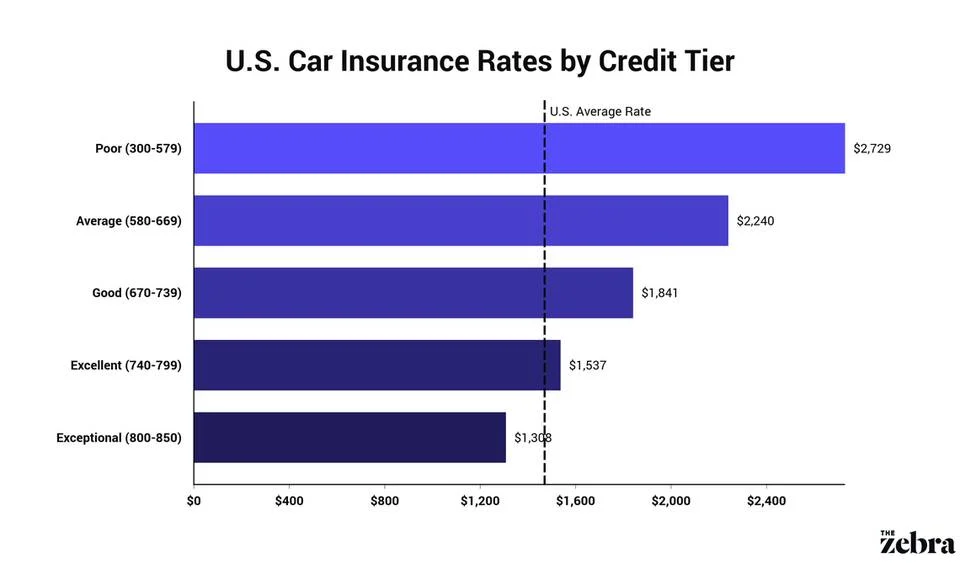

Now I already knew that your credit had some factor in how much you pay for insurance. But did you know that people with poor credit could pay near two times the amount for insurance than someone in the 700s?

Studies done by researchers and journalists from The Zebra have found that the vast majority of insurance companies WILL charge different rates directly correlated to your credit score, and that most customers aren’t even aware of this being a factor in their policy. If you ask me, the way you manage your finances shouldn’t be considered in how safe of a driver you are. I don’t think a maxed out credit card make me more likely to be involved in an accident, but to insurers you are more of a liability.

So What’s The Best Way To Work Around This?

Now I know the instinct is to hit up Google and ask “how do I get cheap car insurance with a poor credit score?” Unfortunately, insurance companies in most states are allowed to use credit ratings as a reason to charge more. Believe it or not, there are only four states in the United States that actively prohibit insurance companies from using someone’s credit score to make decisions regarding an insurance policy. So if you live in California, Hawaii, Massachusetts, or Michigan, then you lucked out on that end.

Many effective strategies exist to help with your credit issues.

This includes negotiating payments, or trying your luck with the “interest snowball” method. There’s nothing wrong with these solutions, but sometimes with the hardships that Americans are constantly being dragged through these days, the funding for options like this simply is not there. This is where we utilize debt relief solutions which are more geared to letting specialists help you get the best deal possible to resolve the debts that you owe, which commonly decreases your monthly overhead by substantial amounts. Results vary based on an individuals situation, but many customers who have worked with a company, such as Curadebt, to help alleviate their debt issues have seen reductions in monthly payments of up to 40%. That’s usually multiple hundreds of dollars back in your pocket.

Good Credit or Bad, You Should Shop Around For Rates.

Insurance is a HUGE industry with a lot of different competitors who want your business. Think about how many cars you see on the road and how they all should be insured by one company or another. Even letting your current insurer know that you’re looking at other companies, essentially threatening to cancel, can spark the conversation on what could be done about the pricing your policy.

Even if you’ve already paid for your policy in full, you’re entitled to a refund for the unused portion of your policy.

You can easily use this to your advantage because a) No company wants to give money back and b) you can put these funds toward a lower-cost policy. If you’re lucky enough, sometimes you can pocket a difference.

Many platforms, such as Jerry, will do all the legwork of comparing rates for you. All you have to do is enter in the cars and desired coverage, and they will pull quotes from several insurers. From there, you can decide for yourself what the best deal is.

Cross The T’s, Dot The I’s

As you would do with a credit report, you want to make sure that all the information on your insurance policy is correct. For example, if your car has a passive alarm system, or anti-lock brake, insurance companies will give you a discount. Perhaps you still have an additional vehicle on your policy that is no longer operable, that can be taken off. Make sure your address is up to date if you’ve moved recently. The change to a different zip code may reflect with a decrease in your rate.

If You Have The Best Rate You Can Get, Do What You Can To Protect It.

Half the work of keeping a decent insurance rate is not getting involved in an accident. Easier said than done, right? Very rarely will you meet a person who’s never been in a car accident in their life. If you haven’t, then congratulations. Despite this, you should always remain on guard. Once an officer shows up and it’s time to write up a report, things can quickly evolve into a “he said, she said” situation. The best way to avoid this is having concrete evidence.

The presence of a dashcam only stands to help your side of the situation. Especially one that records both what’s in front of you, and the inside of the vehicle’s cabin. That way you have documentation of both the collision, and any injuries that occurred to your party as a result. At the time of writing, Rexing is offering $70 off of one of their best Dual Dash Cameras. Not only do you have the benefit of active recording, you can also pull and monitor footage directly from your phone. Gone are the days of popping an SD card out and digging through files on a computer.

Explore Bundling Your Rates

Now this option would work more on a case by case basis. But, sometimes we have our coverages split across other companies for different reasons. Whether it was work related or if we just had a rate locked in at the time. In other cases, maybe our life situation has changed where it would make sense to look into a home or life insurance policy. With those considerations in mind, open up a conversation with your insurer about how adding any one of these policies to your account could lower your payment or be more cost-effective than holding them individually.

Take a Refresher Course.

Insurance companies love people who know the rules of the road. Even more, they love defensive drivers. These are the types of people who actively avoid accidents. And less accidents, of course, cost less money. Many insurance companies’ websites will have a spot for you to indicate whether you’ve taken a defensive driving course before, and how recently this was.

This is especially helpful if you’ve recently gotten into an accident or received a traffic violation. Both insurers and governments like to see that you’ve done everything in your power to address any issues on your side of the equation.

Try To Save On Other Car Related Expenses.

One of the other ways to have cash readily available for the insurance bill is to try and save on other car expenses. For example, doing your own minor repairs. For example, I just had to replace the “Blend Door Actuator” on my car. While, yes, it is quite a bit of work to tear open your dashboard and try and reach certain parts, it’s not impossible, With that, I only spent around $30 in parts, as opposed to paying $200 for someone else to do it with the added labor costs.

Other maintenance that isn’t too difficult to DIY may include:

- Oil Changes

- Tire Rotations

- Cleaning and Detailing

- Changing Spark Plugs

Another place you can always save money on is gas. I use an app called Upside whenever I need to buy gas, and often for food too. They always have several offers open that can save you anywhere from $0.05 to $0.30 per gallon. As for food, sometimes you can get up to 25% in cashback. (If you decide that this would be useful for you, make sure you use the code LOUIS9354. It let’s them know I sent you.)

So unfortunately, while most of us citizens of the US can’t stop insurance companies from using our credit ratings to increase our policy rates, we can still take action. Whether it’s working directly to lower your rate, or fixing your credit to get back to a lower rate, some key ways to alleviate the stress of a high insurance bill include:

- Verifying the information your insurance company has

- Choosing the optimal plans and coverages for your situation

- Bundling any separate or new policies.

- Taking a defensive driving class

- Taking charge of your car’s maintenance.

Let us know if there’s any other tricks and ideas you guys have to save money on insurance and other car related expenses.