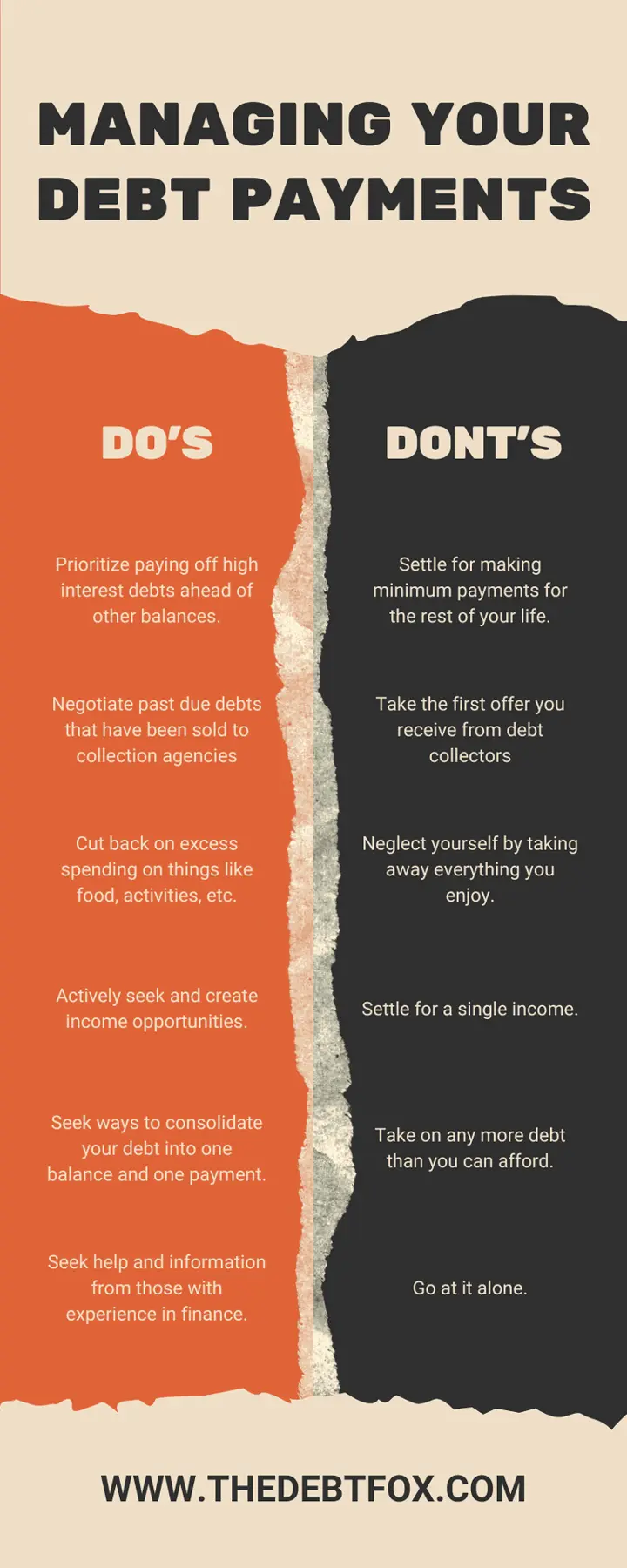

Today we're going to take a moment to talk about some of the best practices in terms of navigating your debt situation, as well as making sure that we're aware of the negative counterparts that exist to these ideas. If you're just starting to realize you have a debt issue this is a good place to start working on these problems.

DO: Prioritize high interest debts ahead of other balances.

They say that interest is the silent killer. It adds to your debt owed MUCH faster than your minimum payments work to bring your balance down. It is so profitably designed that it can leave people feeding the bank until they die. Even if you have higher balances on other card, resolving your higher interest debts makes a much bigger difference than it looks like, as you have less being added to your debts than if you were just pay off whatever full balance you are capable of at the time. It's a move think forces you to look at the different moving parts involved with keeping you in debt.

DON'T: Settle for making the minimum payments for the rest of your life.

Even your bank won't keep you around for long enough to let this happen. Even in situations where you are making payments, your bank can still sell your debt to a collection agency if they feel that they won't recoup the losses involved with your account. At that point, you'll be stuck, either paying out a large sum to a debt collector, or being harassed with constant attempts to collect on the debt.

DO: Negotiate past-due debts that have been sold to collection agencies.

Remember that collection agencies aren't buying your debt for the full amount owed. Often times, the banks are selling past-due accounts off for pennies on the dollar. That means some company is buying up your $5,000 credit card account for anywhere between $50-$100 or so. They're able to do this because they buy several accounts at a time, making the deal worthwhile for the banks to recoup some funds. That being said, even though you owed the bank $5,000, the collection agency may be willing to settle on a much lower amount because they would still make a profit. They may even offer a settlement before you do.

DON'T: Take the first offer you receive from a collection agency.

Remember that, while settling for a fraction on the total debt, collection agencies still run on an EXTREMELY profitable business model. Keep in mind how little is spent of acquiring your debt, because these people will prey on anyone who isn't aware of it. The first offer that you get from a collection agency likely still brings the company several hundred percentage points in profit. Take the time to negotiate for a lower amount, no matter how good the deal sounds because even at 20% or 30% of the original debt total, they're still making a massive profit on what you pay back.

DO: Cut back on excess spending on things like food, activities, etc.

Eating out and partying are two things that rapidly drain your wallet. Remember how we talked about debt collectors profiting several times over on accounts? Restaurants and bars are pretty similar. You can grocery shop and end up spending $2 - $4 per meal. Now imagine picking up food from a restaurant for every meal. You would like spend AT LEAST $50 a day. Maybe $30 if you're frugal about it.

DON'T: Neglect yourself by taking away everything you enjoy.

While you need to save money, you should also practice moderation. There's no point in depressing yourself by sticking to a strict regimen of ramen noodles and water for months on end. Practice budgeting, and find criteria to achieve in your daily life so that you can reward yourself with a night out maybe once every couple of weeks. Everyone's situation is different. Figure out how to do this in a way that is truly affordable to you.

DO: Actively seek and create income opportunities.

Side hustles are ingrained in the American culture today, especially with the state that our economy is in. There's a lot of different ways to generate income outside of your main career. Do some research on different methods of generating income, such as content creation, affiliate marketing, and reselling. Some people even go on to turn their side jobs into their main career because of how profitable it can be.

DON'T: Settle for a single income.

Most pleads to employers for a living wage have fallen onto deaf ears. If you don't look for other ways to make money, you leave yourself at the mercy of your job. Either way, whatever you're doing, you know your job already isn't enough to support your lifestyle. If it was, you wouldn't have built up an overwhelming amount of debt in the first place, right?

DO: Seek ways to consolidate your debts into one balance and one payment:

Under one account you don't have to worry about keeping track of multiple different interest rates that accumulate and change over time. Consolidation slows the rate in which your balance grows, as well as making it possible to get ahead while paying less every month. On your free consultation, make sure you ask how much you can save every month by consolidating your debts.

DON'T: Take on more debt than you can afford.

Looking out for new loans to cover old ones or trying to borrow a quick hundred or two from someone can lead you down a slippery slope. Remember how you didn't think you'd get here when you took out your first credit card? Borrowing when you know you shouldn't be creating more obligations for yourself can only lead to more suffering.

DO: Seek help and information from those with experience in finance.

In this century we've been blessed with more access to knowledge than ever before. I like to think that I'm taking part in the accessibility of this knowledge. There's always many great resources online that can teach you different debt repayment strategies and talk about different ways to generate income. This is also a great way to introduce yourself to healthier financial habits, as well as investing strategies for your debt-free future.

DON'T: Go at it alone.

Suffering alone is never easy. Humans are social creatures. If you feel as though you have more on your shoulders to handle, please seek support from someone you love or trust. It took a long time for me to come out and talk to my family about how much money I owe, but they did come at it from a very understanding point of view. You may be surprised at how the ones you love react. Remember, they're not there to judge you.